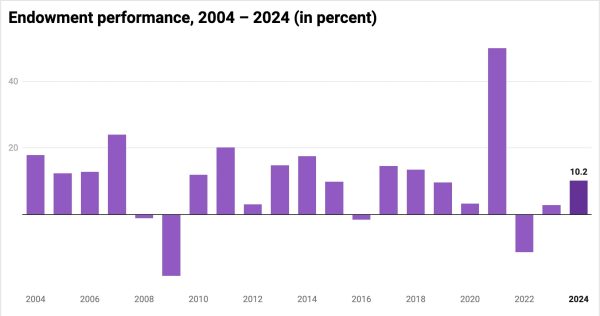

The College’s endowment delivered a return of 10.2 percent for the 2024 fiscal year, bringing its total value to $3.65 billion — the first time the endowment has increased in value since 2021.

The investment return — 7.2 percent when adjusted for inflation — corresponds to $345.5 million earned by the College’s investments during the 2024 fiscal year, which ended on June 30. The College also transferred $178 million to its operating account to cover 55.6 percent of this year’s annual budget.

The endowment’s strong performance comes after two consecutive years of declines, which, in conjunction with inflation, prompted the College to cut budgets and slow hiring in 2022. In 2023, the College’s investments delivered a return of 2.9 percent, but spending outpaced investment gains. In 2022, the endowment fell by 11.2 percent — its weakest performance since 2009.

The high-water mark for the endowment is still $4.2 billion, which the College achieved in 2021 after the Investment Office reported a return of 49.9 percent.

The 10-year return of the College’s investment pool is now 9.19 percent. The investment office relies more on long term metrics such as the 10-year return, rather than single-year earnings, to evaluate investment strategy, Chief Investment Officer Abigail Wattley ’05 told the Record last year.

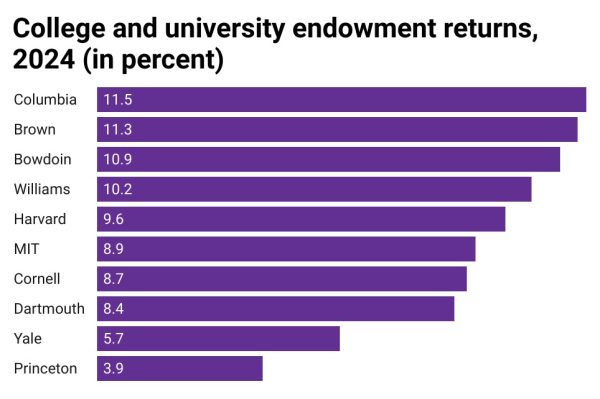

Peer institutions reported similar figures this year. Bowdoin, Yale, and Harvard, for example, reported gains of 10.9, 5.7, and 9.6 percent, respectively.

The endowment’s returns follow months of campus debate regarding the College’s investment practices.

Last spring, in response to the ongoing war in Gaza, student protestors called on the College to divest from weapons manufacturers supplying the Israeli Defense Forces; adopt environmental, social, and governance (ESG) standards; and increase transparency regarding strategies that inform the College’s investments.

The Advisory Committee on Shareholder Responsibility (ACSR) convened in February to consider these demands and a request submitted by Professor of Philosophy Steven Gerrard that opposed divestment. Ultimately, the ACSR recommended against divestment and exclusionary ESG standards but encouraged the Investment Office to increase transparency where possible, recommendations that the Board of Trustees adopted in full in June. The Investment Office launched the first of these transparency measures, a website that offers information about the College’s investment strategy, earlier this month.

Each year, the College draws from the endowment in order to support its operating expenses. There is, however, a limit to the amount that the College can take from the endowment in a single year. If the College consistently draws too much, it runs the risk of shrinking the endowment, thereby reducing the resources available to future generations of students at the College. Over the long-run, the provost’s office considers a 5-percent draw rate to be sustainable, according to its website.

In October 2022, after a year of lower-than-average investment return and record-high inflation, the provost’s office estimated that the College’s expenses were growing significantly faster than its revenues — which, in the long-run, would cause the College to draw from the endowment at an unsustainable rate. In response, the College implemented cost-cutting measures, including a 15-percent reduction in budgets for dining, academic departments, and library services, and a 33-percent cut to funds for student employment.

In a Dec. 2023 report, after the endowment returned 2.9 percent that fiscal year, the provost’s office estimated that the College would need to draw 6.5 percent of the endowment to fund its budget by 2033, well above the 5-percent threshold.

This year, in a May 10 report, the provost’s office estimated that the College’s long-term draw rate now stands at 4.6 percent.

The report explains that the move toward a more sustainable draw rate rests on “disciplined growth in faculty salaries, staff salaries, and managers’ budgets” — ensuring that full-time staff are hired “only when there is compelling need” — and on last year’s 5.7-percent increase in the student comprehensive fee.

Three years have passed since the Board of Trustees’ investment committee voted to phase out all indirect investments tied to fossil fuels by 2033. In an email to the Record, Wattley wrote that it remains too soon to assess the impact of this decision.

The College typically releases its investment reports, which contain more in-depth information regarding the endowment and its performance, each December.