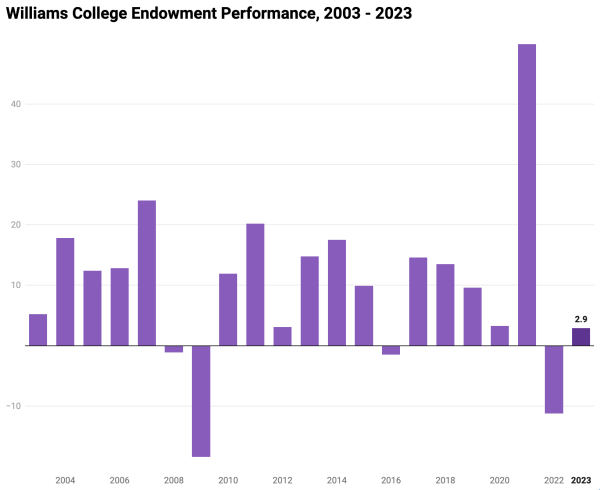

The College’s endowment delivered a return of 2.9 percent for the 2023 fiscal year.

The investment gain, valued at $102 million, was offset by a $150 million distribution to fund the College’s budget. As a result, the market value of the endowment now stands at $3.48 billion, a decrease of $48 million from last year.

The modest return comes on the heels of two years of dramatic changes in the value of the College’s investments. In 2021, the College reported a 49.9-percent increase driven by strong returns in private equity and venture capital funds. In 2022, the endowment fell by 11.2 percent, its weakest real return in 47 years. 2023 is now the second consecutive fiscal year in which the total value of the endowment has declined.

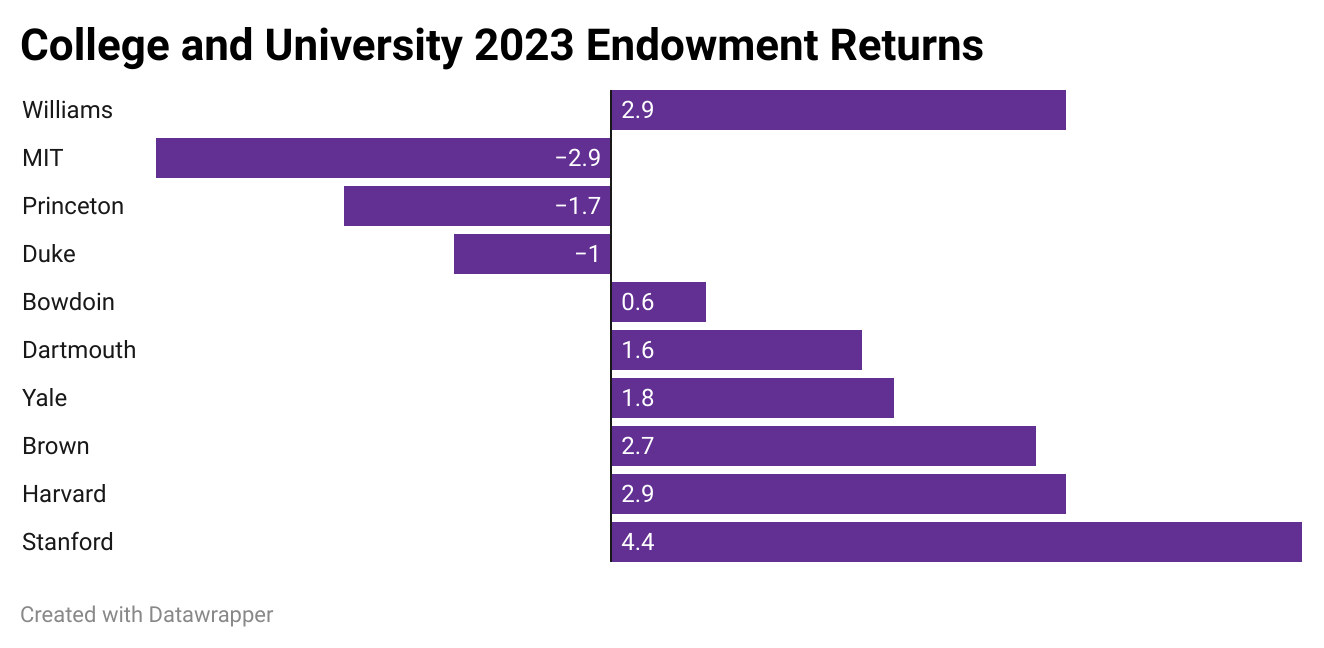

Many of the College’s peer institutions have reported similar results for the 2023 fiscal year. Bowdoin’s endowment increased by 0.6 percent, Stanford’s investments returned 4.4 percent, and Duke announced a 1.0-percent loss. At Harvard, Yale, and Princeton, spending exceeded returns, causing the value of all three institutions’ endowments to decline.

Many colleges and universities, including Williams, continue to have significant investments in private equity and venture capital, two asset classes which performed poorly this fiscal year. “It was a difficult year for venture capital,” Chief Investment Officer (CIO) Abigail Wattley ’05 wrote in an email to the Record. “However, this asset class has been the top performing asset class six of the last 10 years.”

“Over the long-term, our investments with venture capital funds have provided Williams with outstanding investment returns,” Wattley continued.

The endowment’s average annual return over the last 10 years now stands at 9.89 percent, according to Wattley. When evaluating budgeting and investment strategy, the College tends to inform its decisions by considering longer-term metrics like the 10-year return rather than the endowment’s performance in any given year.

Last year, record-high inflation, which coincided with the College’s negative endowment return, prompted the College to cut its operating budget and slow hiring for the 2024 fiscal year. Despite these measures, the College will draw 2.7 percent more from the endowment this fiscal year than the year before.

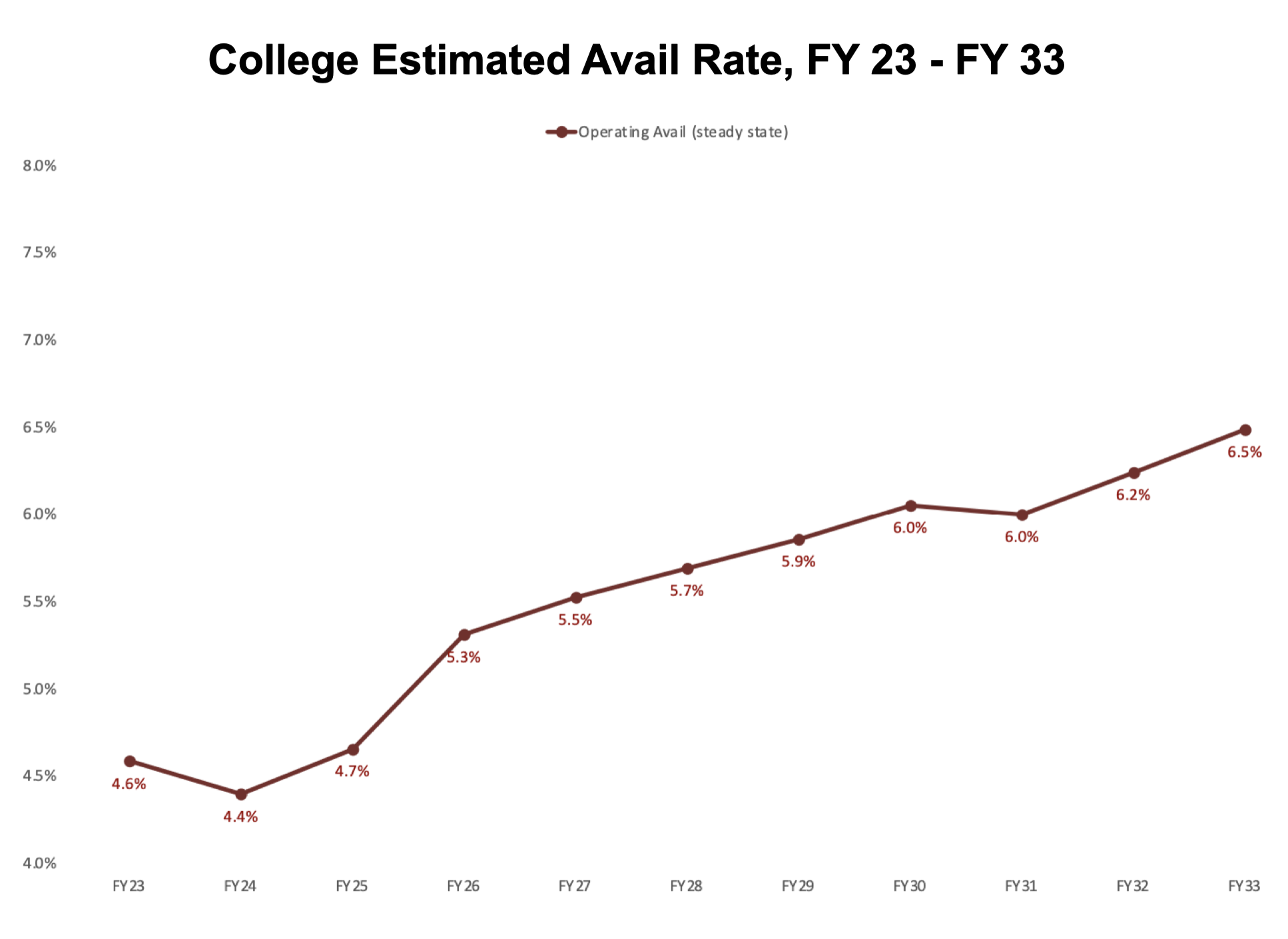

This year, the College’s avail rate — the percentage of the endowment it must withdraw to fund its budget — was 4.5 percent. If expenses and revenues continue to grow at their current rates, the College estimates that its avail rate will climb to 6 percent by the 2030 fiscal year. This predicted figure lies above the 5-percent threshold that the College considers sustainable in the long-term.

The budgeting process for the next fiscal year is still in its preliminary stages, according to Provost Eiko Maruko Siniawer ’97. “The fiscal year 2024 budget and planning for fiscal year 2025 and beyond are purposely intended to ensure the College’s financial sustainability in the long term,” she wrote in an email to the Record.

“Ongoing efforts to manage revenue and expense growth will enable the College to sustain its financial strength, support its core academic commitments, and advance its strategic priorities, today and well into the future,” she added.

Two years have passed since the Board of Trustees’ investment committee voted to phase out all investments tied to fossil fuel extraction by 2033 and stop making new investments in fossil fuels immediately. According to Wattley, the impact of this decision on returns is still uncertain. “The returns of oil and gas investments vary, of course,” she said. “And it will take time for existing investments to roll off.”

The College has not disclosed its current exposure to funds associated with fossil fuel extraction. The Investment Office allocates 4 percent of the endowment toward real asset portfolios, which can include oil and gas projects, but also can include assets such as timber, infrastructure, and renewable energy projects. As time passes, the proportion of the College’s investments that are tied to fossil fuels will continue to decline.

“Oil and gas investments are often considered an effective hedge against inflation,” Wattley wrote. “You saw that last year when inflation was 9 percent and our real assets portfolio returned over 40 percent.”

“We continue to add inflation-hedging investments to our portfolio,” Wattley continued, citing real estate assets as one alternative protection against inflation.

The College also maintained its $50 million allocation toward impact investments, which support funds aimed at reducing global greenhouse gas emissions.

This fiscal year also marked the end of Collette Chilton’s 17-year tenure as CIO. Wattley, who succeeded Chilton on July 1, said that she did not expect her investment strategy to differ significantly from Chilton’s approach.

Wattley stated that the Investment Office did not make any material changes to its long-term strategy this year.

“Colette was a great investor and leader,” Wattley wrote. “You will not see some dramatic ‘new way’ of managing the College’s portfolio. A consistent long-term focus has advantages.”

The College’s investment reports, which contain more in-depth information regarding the endowment and its performance, are typically released in December.