When the College launched its all-grant financial aid program for the 2022–23 academic year, it became the first institution of higher education in the nation to eliminate loans, required work study, and summer earnings contributions from all students’ financial aid packages.

“The real motivation was thinking about how we can invest our resources in ways that will make this experience the most robust and equitable one for them,” Dean of Admission and Student Financial Services Liz Creighton ’01 told the Record.

To better understand the results of the all-grant financial aid program, the College’s Office of Admissions & Financial Aid — with support from the Institutional Research team and Human Resources — spent the summer analyzing data from its first year to determine the impact of the program, according to Creighton.

“We went into the summer’s analysis curious if that high-level goal had been met, based on what the data showed and what students told us about their experience in the first year [of its implementation],” Creighton said. “Generally, we found that the program was highly successful in doing that.”

The College began its study last summer, drawing data from the entire 2022–23 academic year, as well as initial data from students newly enrolled in the Class of 2027. Using a combination of student and parent surveys, student focus groups, and data collection, the College captured both quantitative and qualitative data to measure changes to student employment, loan borrowing behavior, and quality of student life.

The surveys, which garnered a 60-percent response, compared student employment and borrowing behaviors in the 2022–23 academic year to that of previous years. In student focus groups, which were led by Strategic Adviser for Admission and Financial Aid Community Engagement Twink Williams Burns ’06, participants discussed the qualitative impacts of the all-grant financial aid program to student life, such as time devoted to mental health and co-curricular activities.

Here are four takeaways from the College’s Year One All-Grant Analysis.

In every income category, student borrowing decreased. Middle-income students saw the highest reduction at 79 percent.

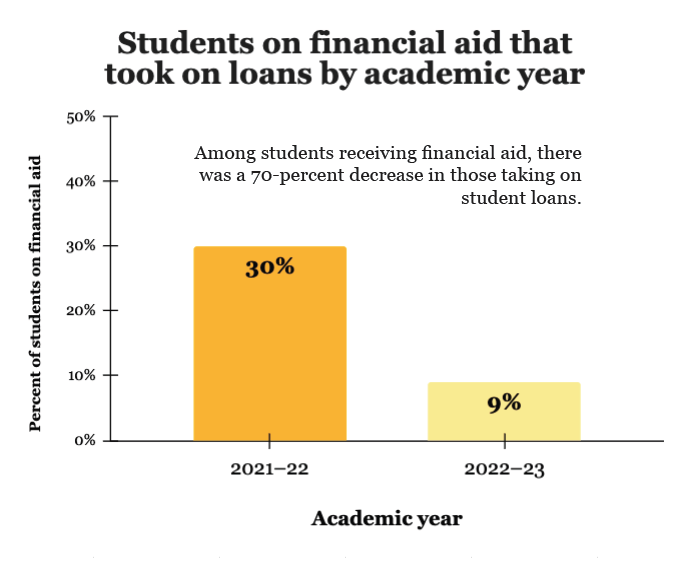

According to Ashley Bianchi, Director of Student Financial Services, the number of students receiving financial aid who took out student loans fell from 30 percent during the 2021–22 academic year to nine percent last year. The decrease occurred across all income categories, which Bianchi called a confirmation of the success of the program for the College.

The most significant decrease in borrowing occurred among middle-income students, defined by the College as students with a household income between $75,000 and $150,000, who saw a 79-percent decrease in the number of students who took out loans. According to Bianchi, this was a demographic that had not seen the full benefits of previous financial aid expansions and was one of the major targets of the all-grant financial aid program.

“We had heard from parent and student data that [it] was really a big, big burden to pay for college within that particular group, so we were excited to see that,” Bianchi said.

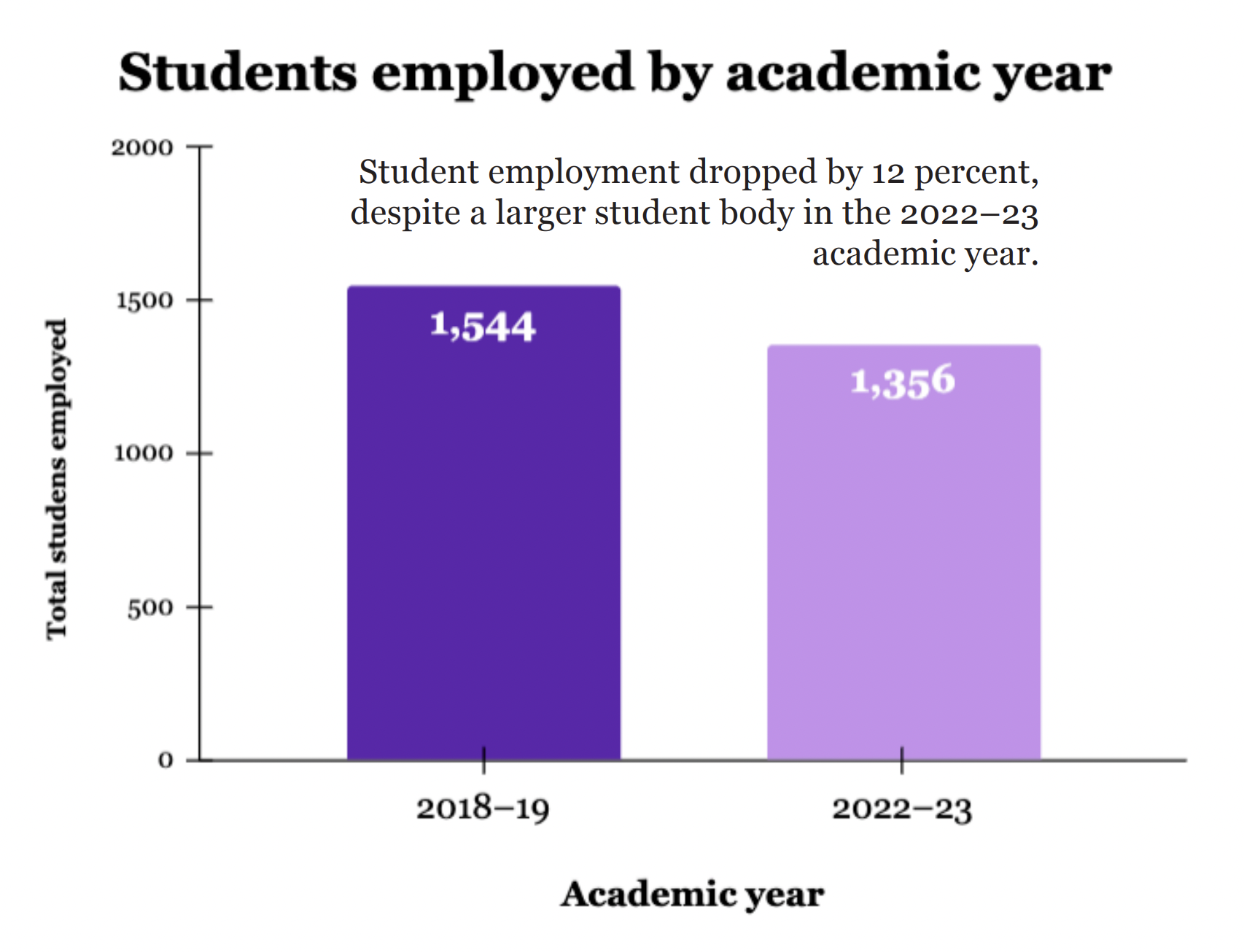

Twelve percent fewer students worked last year as compared to the 2018–19 academic year — even as the College’s student body reached its largest size last year.

The survey found a 12-percent decrease in the number of total students working at the College and a 20-percent reduction for students receiving financial aid. Among the total population of students who worked, the survey also found a 20-percent decrease in hours worked. The 2018–19 school year was used as a point of comparison against last year’s employment data to avoid the impact of the COVID-19 pandemic on student employment behavior, according to Bianchi.

Last year, the College raised the student weekly work limit from 10 to 20 hours and added additional student positions to its residential life and housing teams. While the College had its most populous student body last year, these changes offered more opportunities for student employment, Bianchi said.

“For us, that’s been one of the interesting aspects of this analysis,” Creighton said. “It wasn’t like everything else held steady and all-grant was the only thing that changed — lots of other things have evolved as well, which made for a noisier dataset.”

Last year, the College cut student employment by $340,000 to meet 15-percent reductions to department manager’s budgets for the 2024 fiscal year. Trends in student employment behaviors, however, are separate from these cuts, according to Creighton. They reflect waning student interest in employment following the implementation of the all-grant financial aid program, she said.

“When all-grant was implemented, it was, in my mind, logical to assume that there would be some reduction in the number of students who worked and the number of hours they worked, because jobs are no longer required, and that’s what happened,” she said. “But the reduction to the student employment budget for fiscal year 2024 only reflects decisions made by individual department managers about their student employment needs — that actually had nothing to do with all-grant.”

Of the classes examined, the study also found that the fewest first-years were employed by the College last academic year, which Creighton attributed to the elimination of the work study requirement. “All other classes arrived at Williams with the understanding that work would be part of their financial aid program,” she said. “This group of first-years did not have that experience.”

Seventy-seven percent of surveyed first-year students receiving financial aid reported all-grant financial aid as a reason to enroll at the College.

In surveys, 77 percent of first-year students on financial aid reported that all-grant financial aid had a “significant positive impact and was one of the main reasons I chose to enroll,” and nearly one quarter of first-year students on financial aid identified all-grant financial aid as the deciding factor in their decision to enroll at the College.

According to Creighton, although the program is intended for current students, it represents a commitment to inclusive admissions practices. “At this moment, when, on the heels of the [Supreme] Court’s decision, we’re redoubling our focus on the commitments that Williams has to being accessible and affordable,” she said. “That this program is already in place goes a long way towards giving us a really solid foundation to work from.”

The College plans to continue its study of the program to inform future strategic planning.

Looking ahead, the College plans to continue its study of the all-grant financial aid program as it heads into future years, especially as the College continues to enroll classes of students who will have only experienced the College under its policies.

“I think we’re really excited to be able to take what we heard from students and build it into the program,” Creighton said. “We’ll keep doing this kind of research and analysis to ensure … that the resources we have are being used in ways that are most important for students.”