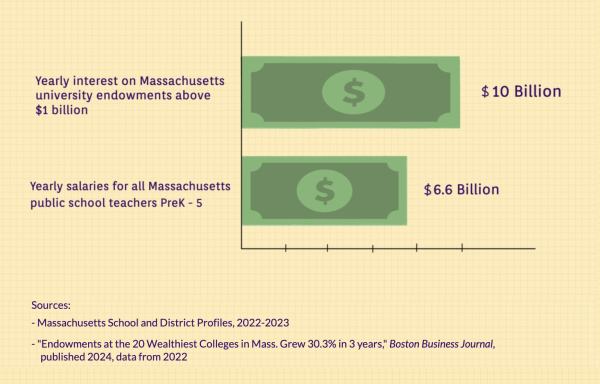

President Maud S. Mandel attended the Annual Day of Advocacy and Action conference hosted by the National Association of Independent Colleges and Universities (NAICU) in Washington, D.C., from Feb. 4 to 7. During her trip, she met with lawmakers in part about concerns over recent state efforts to tax the large endowments of some higher education institutions. The trip follows the recent proposal of a Massachusetts state bill — titled “An Act to Support Educational Opportunity for All” — that would impose an annual 2.5-percent excise tax on endowments of higher education institutions whose assets are valued over $1 billion to fund statewide public education initiatives.

Mandel has been a board member of the Association of Independent Colleges and Universities in Massachusetts (AICU Mass), the Massachusetts affiliate of NAICU, since June 2022. AICU Mass, through the lobbyist firm O’Neill and Partners, advocates on behalf of its 59 private nonprofit college and university members in support of “increased funding for need-based financial aid programs, economic and workforce development support, incentives for college savings programs, additional funding for research and innovation, and to protect the tax-exempt status of nonprofit colleges and universities.”

Since its founding in 1967, AICU Mass has lobbied against several Massachusetts state bills aimed at taxing private higher education endowments, including, most recently, “An Act to Support Educational Opportunity for All.” If enacted, the funds collected by the bill — sponsored by Massachusetts State Representatives Natalie Higgins and Christine Barber — would fund debt-free education at 29 public Massachusetts colleges and universities, provide costof-living grants to students, and fund universal pre-K through the tax on private endowments, Higgins told the Record in February.

In Washington, Mandel and other members of AICU Mass met with congressional Reps. Richard Neal, Jim McGovern, and Bill Keating to discuss the importance of the Federal Pell Grant Program, the role of private colleges and universities to Massachusetts’ economy, and her concerns about recent efforts to tax large endowments and “regulate the independence” of higher education institutions, Mandel wrote in an email to the Record. Neal represents the 1st District of Massachusetts, which includes all of Berkshire County. He has previously opposed state taxes on college endowments.

The College is a nonprofit and 501(c)(3) tax-exempt organization that is prohibited by the Internal Revenue Service (IRS) Code from engaging in all political campaign activities, but General Counsel to the College Jamie Art explained that Mandel’s trip to Washington was permitted under the regulation.

“College policy prohibits the use of College resources to support or oppose candidates and ballot initiatives,” he wrote in an email to the Record. “In contrast, the tax code allows nonprofits with 501(c)(3) status to engage in a limited amount of issue advocacy or lobbying to influence legislation without jeopardizing their tax exempt status.”

The College pays dues to several advocacy organizations that may engage in lobbying, including the National Association of College and University Business Officers, the Consortium on Financing Higher Education, and the Association of Governing Boards of Universities and Colleges. Those payments are reported to the IRS on Form 990, Art wrote.

“If the IRS determined that the College’s lobbying expenses or activities constituted ‘a substantial’ part of its overall activities, it could lose its income tax exemption,” he explained. “Measured against the whole of its activities, the College’s lobbying and issue advocacy efforts and expenses constitute a small sliver of the pie.”

AICU Mass has also lobbied against other bills aimed at regulating private educational institutions. Beyond endowment legislation, they have opposed “An Act to prevent nonprofit institutions from avoiding wetlands or natural resource protections under the so-called Dover Amendment.” This would amend existing zoning regulations to allow for restrictions against educational nonprofits’ development on wetlands and natural resource protection areas.

AICU Mass also opposes “An Act to advance fairness, integrity, and excellence in higher education admissions,” a bill seeking to end preferred admissions for legacy students, children of donors, and early decision applicants. Colleges and universities affected by the bill would pay a fee proportional to the size of their endowment per student; the College would pay an estimated 0.15 percent of its endowment annually.

Will Royce contributed reporting.