Mandel releases public statement on fossil fuel investment plan, divestment organizers celebrate

April 13, 2022

The College plans to end all indirect investments tied to the fossil fuel industry by 2033, President Maud S. Mandel announced in an all-campus email on Friday, prompting celebration from divestment organizers and confusion from some other students. In October 2021, Mandel announced in a faculty meeting that the College has held no direct investments in fossil fuels since 2015 and would be eliminating the 4 percent of the endowment indirectly invested in the fossil fuel industry in the next several years, though she did not make a public statement announcing divestment at that time.

“Until now, I have been reluctant to write a letter announcing such changes to the portfolio both because the process we and other schools have launched will take years to complete, and because I am skeptical that these changes or a statement about them will have any direct impact on the climate crisis,” Mandel wrote in the email. “I hope this clarifies questions about college investment strategies in this arena.”

Mandel sent the email the day after she, Provost Dukes Love, and two members of the College’s Board of Trustees met with five representatives of Williams College Young Democratic Socialists of America (YDSA), who called on the College to make a public statement regarding their investments tied to fossil fuels.

“Removing $160 million from the fossil fuel industry isn’t going to cause the collapse of the fossil fuel industry,” Lauren Lynch ’23, a YDSA organizer who was present at the meeting with Mandel, said in an interview with the Record. “But the point of this [statement] is to stigmatize the fossil fuel industry, to put Williams’ name on the line with that movement, and to provide an example for other campuses to do the same.”

In recent years, many peer institutions, including Cornell, Amherst, and Harvard have released similar statements stating that they would be transitioning away from all direct and indirect investments in the fossil fuel industry.

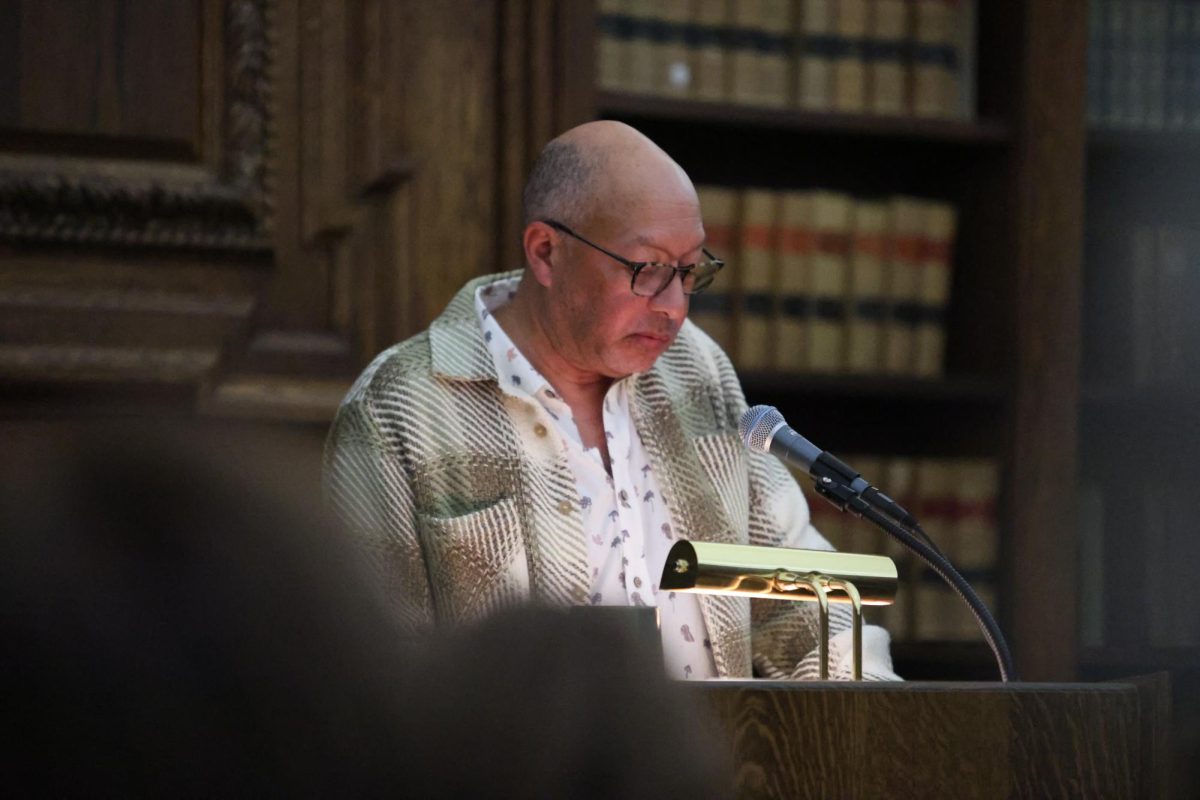

In response to Mandel’s email, YDSA hosted a celebration attended by approximately 50 students on Friday in front of Paresky Center. “We got confirmation from President Mandel that the College would finally be committing to a policy of phasing out all fossil fuel investments,” Coco Rhum ’24 said in a speech during the event. “We want to emphasize how big of a deal this is, even if the email sent out today may have downplayed it a bit.”

However, Kedar Veeraswamy ’24, co-president of Williams Environmental Council (WEC), said that while the email demonstrates the College’s receptiveness to public opinion, it still fell short of his expectations. “[Mandel] didn’t change anything, and that’s frustrating for people who expected the public statement to be something that it wasn’t,” he said. “I’m happy that YDSA considers this a win, but I’d say that there’s more work to be done.”

Other students expressed confusion over the YDSA’s celebration. “I didn’t, at first, realize that [Mandel’s email] was what YDSA was so excited about,” Sam Sidders ’25 said. “Me and a few friends were like, ‘Oh, is that all they wanted? Nothing has actually changed here.’”

Liv Chambers ’25 communicated a similar sentiment. “To me, it appears that the school is continuing on with exactly the same policy that had been in place prior to recent calls for divestment,” she wrote to the Record. “I think that Maud’s email begs the question as to how much has really changed.”

Lynch predicted that the email may have disappointed students in part due to Mandel’s choice to refrain from using the word “divestment” in her email, a decision that Mandel explained was intentional. “To divest is to sell off assets and we have no direct investments in fossil fuels to sell off,” Mandel wrote in an email to the Record. “What we had was a small number of partnerships that we are now allowing to expire… We simply felt it wouldn’t be accurate to call this ‘divesting.’”

Mandel’s decision to withhold from using the word “divestment” aligns with the language of statements made by many other peer institutions that have announced their plans to phase out investments tied to fossil fuels.

Lynch said, however, that YDSA used the word “divestment” to refer to Mandel’s statement because it was a buzzword associated with their organizing movement. “We’re calling this divestment because this is what we’ve been fighting for,” Lynch said. Still, Lynch added that she understood Mandel’s reasoning behind her choice of words.

While Director of the Center for Environmental Studies and the Environmental studies program Nicolas Howe said that making a public statement was “the right thing to do,” he also expressed indifference over the terminology Mandel used in her email. “I don’t really care whether or not we call it divestment,” he wrote in an email to the Record. “What matters to me is the moral significance of publicly disentangling ourselves from the fossil fuel industry, however it is framed.”

In 2015, both students and alums spearheaded a push for divestment that led to a public statement from then-President Adam F. Falk. The efforts included a proposal signed by over 500 members of the College community, calling for divestment from 200 companies identified as having the largest reserves of fossil fuels.

In his statement, Falk noted that as of that June 2015, the College had no direct holdings in any of the 200 companies referenced in the proposal, a result of a decision the College had already made at the recommendation of the Investment Committee of the Board of Trustees several years prior. Still, Falk acknowledged that the College had not divested completely, describing divestment as “a largely symbolic strategy, with little likelihood of having a substantive impact on the economic or social forces responsible for climate change, or on the political decisions that are necessary to address it.”

The College’s response to the 2015 proposal was not to divest, as the proposal requested, but rather to invest $50 million in sustainability projects over the next five years. The projects included sustainable construction and renovation of buildings on campus, academic programs, community programs, and impact investments, Falk said in an interview in the Spring 2017 edition of the Williams College magazine.

Mandel referenced the same investment statistic in her all-campus email, writing that “Williams has committed $50 million into these funds and we continue to dedicate significant time and resources to exploring opportunities in this arena.” The College’s 2021 Strategic Plan broadly explained that the College planned to continue “to invest the endowment in impact investments that promote measurable reductions in global carbon emissions.”

Daniel Shearer ’04, an alum who was involved in divestment efforts among graduates of the College and who assisted in the creation of the proposal, met with Falk and members of the Board of Trustees in 2015 to discuss the organizers’ demands. In the meeting, Falk made clear that he did not believe in the mission of divestment, Shearer said in an interview with the Record. “I see that theme in the current president’s message,” Shearer said. “[Mandel’s email] reads as ‘We’re doing this, but we still don’t think it actually matters that much.’”

Still, Shearer appreciated that Mandel released a statement detailing the College’s investment strategy regarding the endowment’s ties to fossil fuels. “There’s the fundamental piece of ‘get your money out of where it shouldn’t be,’ but in some ways, there’s even more value in how you tell the story.”

A previous version of this article incorrectly stated that Coco Rhum is in the class of 2023. She is in the class of 2024.