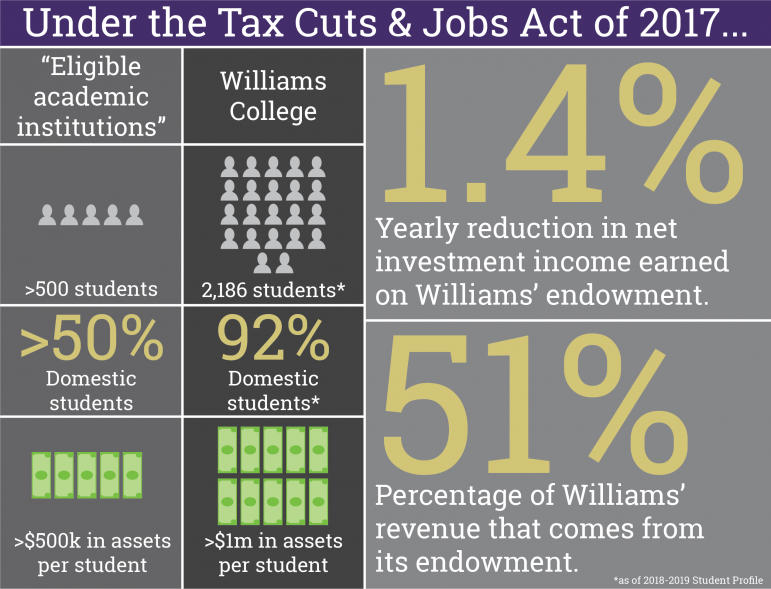

In 2017, Congress passed the Tax Cuts and Jobs Act, a law that included a tax on the returns from certain college and university endowments, of which the College’s endowment is one.

This past summer, the U.S. Treasury Department released a document outlining which institutions would be affected by the tax and to what extent. The document describes “eligible educational institutions” as private colleges and universities with at least 500 tuition-paying students, more than half of whom are located in the U.S., and whose assets total at least $500,000 per student.

According to the College’s 2018 Investment Report, the endowment, one of the largest per student amongst private colleges and universities in the country, has a principal of more than one million dollars per student, thus qualifying the College, as well as many peer institutions, for this tax.

“The tax will reduce our endowment each year by 1.4 percent of the net investment income earned on our endowment,” Vice President for Finance and Administration Frederick Puddester said. “Since we draw about 5 percent of our endowment each year, this reduction in the endowment will mean less money to support programs and spending at the college.”

Although the government has not released final guidelines, Puddester predicts that the tax payment could range from one to three million dollars per year and will come from the endowment’s income.

The College has yet to decide where it will cut spending. “That will be decided in the budget process which begins this winter,” Puddester said. The first payment is due this November.